The 30/70 Rule: Pay Yourself First and Take Control of Your Financial Future

As a woman optometrist, managing your finances effectively can feel overwhelming amid the demands of running a practice and maintaining a balanced life. One key strategy to secure your financial future is the 30/70 Rule, a powerful principle popularized by financial experts like Robert Kiyosaki. This rule emphasizes paying yourself first—an essential step toward building wealth, financial security, and long-term success.

In this blog post, we’ll explore the 30/70 Rule, provide actionable steps, share relatable stories, and offer expert insights to help you apply this principle effectively.

1. What is the 30/70 Rule?

The Concept:

The 30/70 Rule is a simple yet transformative approach to managing your income. It involves allocating 30% of your earnings toward paying yourself first and using the remaining 70% for living expenses, debt repayment, and other financial commitments.

Why Pay Yourself First?

- It prioritizes giving, savings and investments, helping you grow wealth over time.

- It ensures financial discipline by allocating funds to your future before discretionary spending.

- It fosters long-term stability, allowing you to manage emergencies and achieve financial goals.

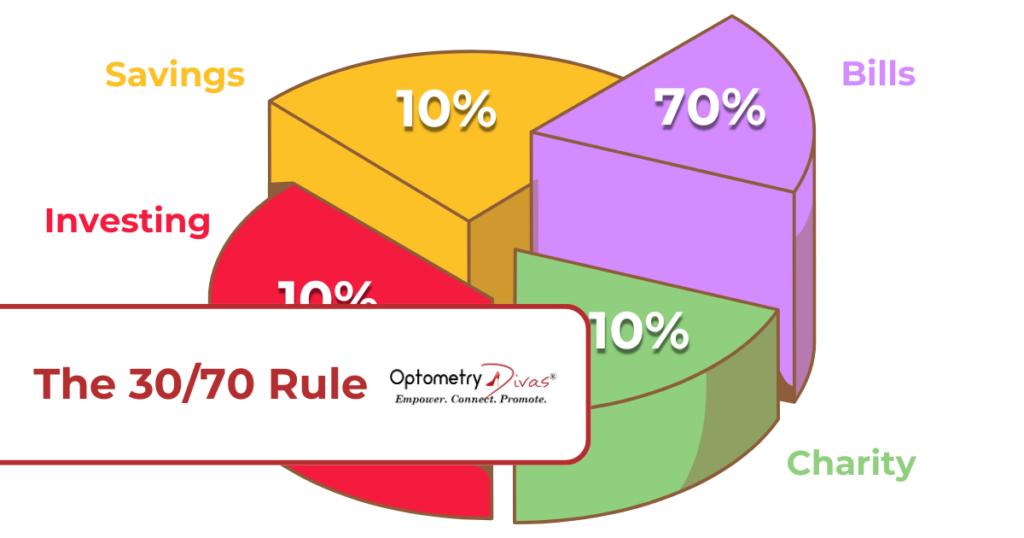

Key Components of the 30/70 Rule:

- 30% to Pay Yourself First:

- 10% to Savings

- 10% to Investments

- 10% to giving to your church or favorite charities

- 70% for Living and Other Expenses:

- Rent, utilities, food, and transportation

- Personal Growth (e.g., education, professional development)

- Debt repayments

- Entertainment and discretionary spending

Quote to Inspire:

“Pay yourself first… The discipline you develop will carry you further than any lottery ticket or lucky break.” – Robert Kiyosaki

2. Why the 30/70 Rule Matters for Women Optometrists

Challenges Female Professionals Face:

- Balancing practice expenses and personal finances.

- Building wealth while managing patients, family, student loans, operational costs, and other responsibilities.

- Planning for retirement and leaving a legacy for family financial security.

How the 30/70 Rule Helps:

By prioritizing your financial health, the 30/70 Rule ensures you’re not just working to pay bills but also investing in your future and achieving financial independence.

Example:

Dr. Olivia Green, a practice owner, struggled to save consistently despite earning a healthy income. After implementing the 30/70 Rule, she allocated 10% of her earnings to an emergency fund, 10% to a diversified investment portfolio, and 10% to give to her favorite charities. Within three years, her savings grew significantly, and she expanded her practice without taking on additional debt.

3. How to Implement the 30/70 Rule

Step 1: Evaluate Your Income and Expenses

- Review your monthly income and identify fixed and variable expenses.

- Categorize expenses to determine areas where you can cut back.

Step 2: Automate Your Savings and Investments

- Set up automatic transfers to savings and investment accounts.

- Explore retirement plans like a Roth IRA or SEP IRA for tax-advantaged growth.

Step 3: Invest in Personal and Professional Growth

- Use 10% of your income to enhance your skills, attend industry conferences, or invest in coaching programs like Dr. Lauretta Justin’s CEO of YOU™ Business Coaching Program.

Step 4: Manage the Remaining 70% Wisely

- Create a budget for living expenses and debt repayments.

- Limit discretionary spending to avoid lifestyle inflation.

Story:

Dr. Megan Patel used the 30/70 Rule to save for her dream of opening a second practice. By consistently setting aside 30% of her income, she accumulated enough to cover startup costs without taking on additional loans.

Tool to track your money

Using smart tools such as Empower Personal Dashboard help you track your spending, saving, investing, and giving goals.

4. Overcoming Common Challenges

Challenge 1: High Debt Load

Many optometrists face significant student loan debt. While this can make saving feel impossible, starting small and staying consistent can still yield results.

Solution:

Focus on paying off high-interest debt with part of your 70% allocation while still giving, saving and investing consistently.

Challenge 2: Irregular Income

Optometrists with variable income streams may struggle to apply the 30/70 Rule consistently.

Solution:

Base your savings on an average monthly income or save a higher percentage during high-income months to offset lower-earning periods.

Quote to Motivate:

“Your future self will thank you for the sacrifices you make today.” – Anonymous

5. Benefits of Paying Yourself First

- Financial Freedom: Reduces reliance on credit and builds wealth over time.

- Preparedness for Emergencies: An emergency fund offers peace of mind in uncertain times.

- Increased Confidence: Managing money proactively empowers you to make bold professional and personal decisions.

Relevant Video:

While it’s important to save 1-12 months of personal living expenses for rainy days, it’s crucial to invest if you want to build wealth. Watch Robert Kiyosaki’s discuss on “Saving” and how investing wisely can change your financial trajectory: YouTube Video

Summary

The 30/70 Rule is more than a budgeting strategy—it’s a commitment to prioritizing your financial health and future. By paying yourself first, you can build wealth, prepare for uncertainties, and achieve your personal and professional goals. Start small, stay consistent, and watch your financial security grow.

References

- Pay Yourself First article by Dr. Lauretta Justin and James Justin

- Rich Dad Poor Dad book by Robert Kiyosaki

- Why Savers Lose their Money

- YouTube: Robert Kiyosaki on Paying Yourself First

- The Total Money Makeover book by Dave Ramsey

- Get Good with Money: Ten Simple Steps to Becoming Financially Whole book by Tiffany Aliche

- Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live book by Cary Siegel

- Profit First for Optometrists book by Rachel Siegel

Disclaimer

This blog is for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor for guidance tailored to your specific circumstances.