How to Avoid Debt

Debt is a common reality for many professionals, especially those in the medical field who have invested heavily in their education and practice. For women optometrists, avoiding debt is not only about financial freedom but also about creating a sustainable, balanced life that allows for growth, flexibility, and peace of mind. In this guide, we’ll dive into actionable strategies, stories, and expert advice to help you avoid debt, build financial security, and focus on what you love—providing exceptional care to your patients.

1. Start with a Solid Financial Plan

Why Financial Planning Matters:

A clear financial plan is foundational to avoiding debt and managing your finances responsibly. Creating a financial roadmap allows you to allocate resources effectively, plan for emergencies by creating a rainy day fund, and make informed decisions for growth without relying on credit.

Key Steps for Building a Financial Plan:

- Set Clear Financial Goals: Once you have identified your current financial status, define short-term, mid-term, and long-term goals, such as paying off student loans, saving for retirement, or investing in your practice.

- Create a Budget: Track your monthly income and expenses carefully, and create a budget that accounts for predictable expenses and unexpected costs.

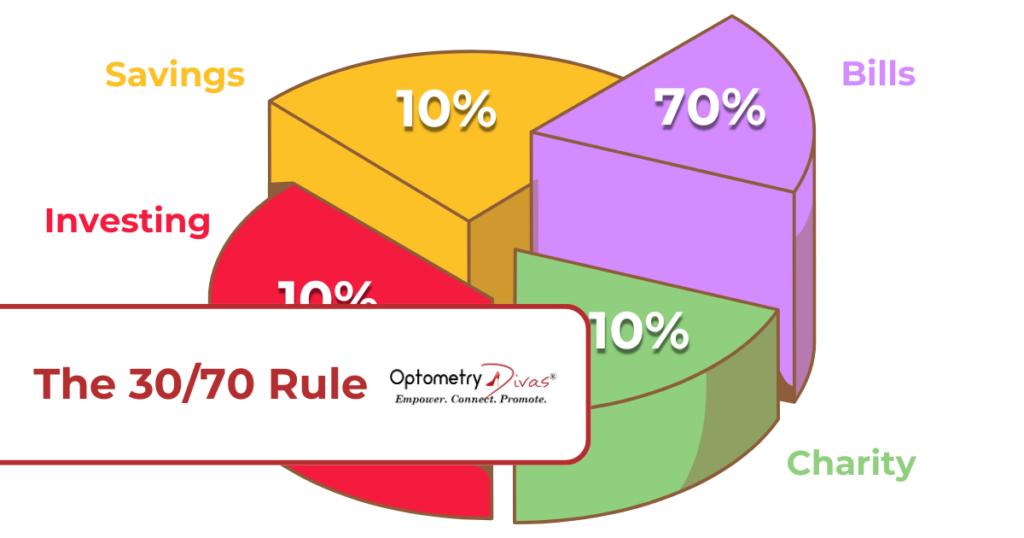

- Pay Yourself First: This personal finance strategy involves setting aside money for giving, investing, and saving before spending it on other expenses. Start paying yourself first by following the 30/70 rule, and take control of your finances to keep more of your money.

- Build an Emergency Fund: Aim for 3-6 months of living expenses in an emergency fund to reduce reliance on credit during difficult times.

Example:

Dr. Susan Lee, an optometrist based in Texas, set a goal to become debt-free within five years of starting her practice. By setting aside a portion of her monthly income toward debt repayment and limiting discretionary spending, she could stay on track financially and avoid accruing additional debt, even when her practice faced unexpected costs.

Quote to Inspire:

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey, The Total Money Makeover

2. Limit Lifestyle Inflation

Why This Matters:

As income increases, it’s tempting to upgrade your lifestyle. This phenomenon, known as lifestyle inflation, can lead to accumulating unnecessary debt if not managed carefully. By keeping your expenses stable, you can direct more of your income toward savings, investments, or debt repayment.

Tips to Avoid Lifestyle Inflation:

- Identify Needs vs. Wants: Differentiate between essential expenses and luxury upgrades.

- Automate Savings: Set up automatic transfers to your savings or retirement accounts.

- Create a Reward System: Treat yourself within budget without overindulging in high-cost expenses.

Detailed Story:

Dr. Rachel Thomas, an optometrist in New York, increased her income significantly after expanding her practice. However, rather than buying a larger home or luxury car, she focused on reinvesting profits and paying off her student loans. By resisting lifestyle inflation, she was able to pay off her loans years ahead of schedule.

3. Make Smart Debt Repayment Choices

Why This Matters:

Most optometrists carry some level of debt from student loans, business loans, or credit. The key to financial stability is to repay debt strategically while avoiding high-interest borrowing.

Debt Repayment Strategies from The Total Money Makeover:

- The Debt Snowball Method: Start by paying off the smallest debt first, then move on to the next smallest. This approach helps build momentum and keeps you motivated.

- Avoid Using Credit for Large Purchases: Pay in cash whenever possible to avoid interest and additional fees.

- Prioritize High-Interest Debt: Focus on paying off high-interest loans first to reduce the overall cost of borrowing.

Example:

Dr. Maria Sanchez used the debt snowball method to eliminate her debt. She started with her smallest loan, paying it off quickly, and then tackled her remaining debts. Each success boosted her confidence and gave her more control over her finances.

4. Be Cautious with Business Expenses

Why This Matters:

Starting and running an optometry practice involves significant expenses, but taking on more debt to grow can sometimes do more harm than good. Being strategic with your business expenses can help you avoid the trap of business debt.

Tips for Managing Business Expenses:

- Start Small: Avoid unnecessary upgrades or expensive equipment until your practice is financially stable.

- Negotiate Terms: Work with suppliers to find favorable payment terms or consider leasing equipment.

- Outsource Wisely: Use external help only when essential, and ensure it fits within your budget.

Detailed Story:

Dr. Jennifer Allen, a new practice owner, initially struggled with the temptation to invest heavily in the latest technology. Instead, she started with the essentials, invested her profits back into the business, and gradually added equipment as her revenue grew. Her careful approach allowed her to stay debt-free and build a stable, profitable practice.

5. Seek Guidance and Continue Financial Education

Why This Matters:

Financial literacy is crucial for avoiding debt and making sound financial decisions. By investing time in learning about personal and business finance, you can avoid costly mistakes and take advantage of opportunities to build wealth responsibly.

Recommended Resources:

- The Total Money Makeover by Dave Ramsey: This book offers a step-by-step plan to get out of debt, build an emergency fund, and live debt-free.

- Rich Dad Poor Dad by Robert Kiyosaki: A popular book on building wealth through financial literacy and smart investments.

- Financial Podcasts and Videos: Listen to reputable financial advisors who discuss topics relevant to business owners and medical professionals.

Quote to Inspire:

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest.” – Dave Ramsey

Summary

Avoiding debt as a female optometrist is achievable with careful planning, disciplined spending, and strategic debt management. By setting clear financial goals, avoiding lifestyle inflation, making smart repayment choices, managing business expenses, and continuing your financial education, you can build a practice and a life that support both financial freedom and personal fulfillment.

References:

- The Total Money Makeover by Dave Ramsey

- Rich Dad Poor Dad by Robert Kiyosaki

- Podcast: The Dave Ramsey Show

- The Optometry Divas CEO of YOU™ Business Consulting Program by Dr. Lauretta Justin – Offers business and financial coaching tailored to female optometrists.

Disclaimer

This blog provides general information about avoiding debt and personal finance and should not be taken as specific financial advice. Please consult a licensed financial advisor or accountant for professional advice suited to your unique financial situation.