Personal Finance 101: Your Fun & Simple Roadmap to Financial Freedom

Money isn’t just paper or numbers in your bank account—it’s a powerful tool that can shape your future and give you the freedom to live life on your terms. Now, let’s be honest—personal finance can feel overwhelming, especially when juggling an optometry career, a business, and a personal life… Right? Yes!

The good news? Mastering money doesn’t have to be complicated or boring!

With insights from financial legends like Robert Kiyosaki, Kim Kiyosaki, Dave Ramsey, Lisa Chastain, and James Justin’s 12 Tips to Achieve Financial Freedom, we’re breaking it all down into 5 easy steps—so you can start taking action today. Plus, we’ll incorporate Dr. Lauretta Justin’s CEO of YOU® Success Philosophy, which focuses on having a Winning Mindset, Winning Strategy, and Winning Team to help you build lasting wealth.

“The first step to getting what you want in life is believing you deserve it.” – Dr. Lauretta Justin

Step 1: Develop a Winning Money Mindset

Money isn’t just about numbers—it’s about how you think about wealth. If you believe financial success is only for the “lucky” or “rich,” you’re holding yourself back. It’s time to switch from scarcity thinking (“I’ll never have enough”) to an abundance mindset (“I’m wealthy, and I’m creating wealth every day!”).

How to Shift Your Mindset Today:

✅ Believe you can be financially free – If others have done it, so can you!

✅ Stop saying “I can’t afford it.” Instead, ask, “How can I afford it?”

✅ Educate yourself – Read books like Rich Dad Poor Dad by Robert Kiyosaki or Girl, Get Your $hit Together by Lisa Chastain.

Example:

Dr. Olivia always thought financial freedom was impossible. But once she stopped fearing money, took a business finance course, and joined a women’s financial empowerment group, she turned her finances around in just two years.

“Your wealth is first created in your mind, and then in your wallet.” – James Justin

Step 2: Budget Like a Boss – Control Your Cashflow

A budget isn’t a restriction—it’s your financial GPS. It helps you tell your money where to go instead of wondering where it went. If you don’t like the word budget, replace it with a financial PLAN and make it fun!

Easy Budgeting Tips:

✅ Use the 50/30/20 Rule or the 30/70% Rule listed below:

- 50% Needs (bills, rent, groceries)

- 30% Wants (fun, travel, shopping)

- 20% Savings & Investments

✅ Zero-Based Budgeting: Every dollar has a job! (Dave Ramsey’s favorite method.)

✅ Use Budgeting Apps: Try Empower Dashboard Click HERE to get started or YNAB (You Need a Budget), or EveryDollar to track your spending.

Example:

Dr. Monica used to avoid looking at her bank account (relatable, right?). But after using YNAB, she realized she was spending $400 a month on subscriptions she didn’t use. She cut unnecessary expenses and started investing the extra money instead.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

Step 3: Crush Debt (The Smart Way!)

Debt can feel like a giant blocking your path to financial freedom—but you can tame the beast with the right strategy.

Two Popular Debt Payoff Strategies:

✔ The Debt Snowball Method: Pay off the smallest debt first for quick wins & motivation.

✔ The Debt Avalanche Method: Pay off the highest-interest debt first to save money.

Good Debt vs. Bad Debt

Note: Not all debt is evil! Good debt (investing in your business, real estate, or education) can help you grow wealth, while bad debt (credit card debt, payday loans) holds you back, and takes money out of your pocket.

Example:

Dr. Lisa had $30,000 in credit card debt. Using the Debt Snowball Method, she focused on paying off one credit card at a time while celebrating small wins. In two years, she was completely debt-free!

“Debt is only a tool—use it wisely, and it will work for you instead of against you.” – Dr. Lauretta Justin

Step 4: Pay Yourself First & Make Your Money Work for You

The secret to building wealth isn’t working harder—it’s making your money work for YOU!

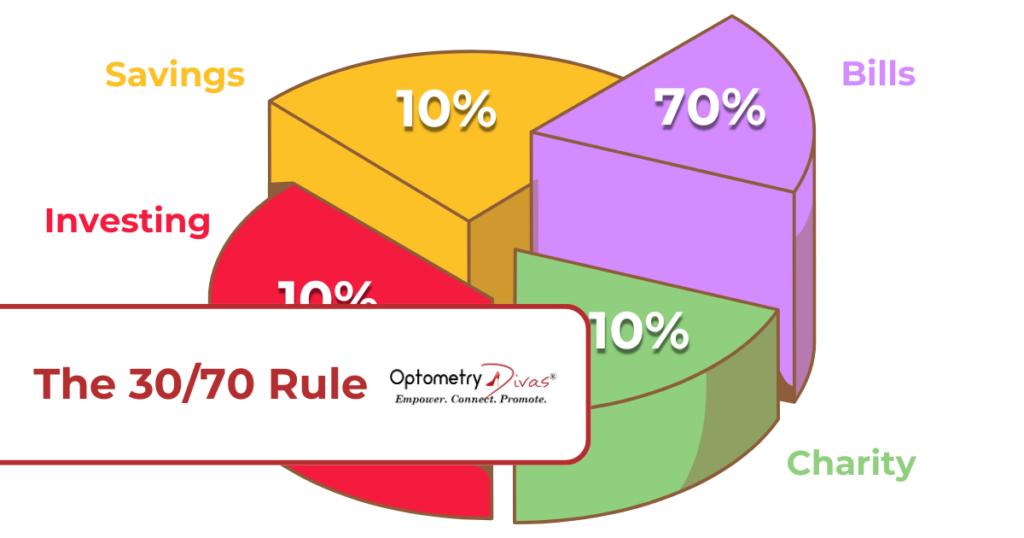

How? Follow the 30/70 Rule

✅ Give Strategically – Put at least 10% of your income into a giving fund. Select your favorite charities or causes you want to support, and automate your giving to save time.

✅ Save for Rainy Day – Put at least 10% of your income into savings before paying bills. Automate your Savings – Set up automatic transfers to a high-yield savings account. You need between 1-12 months of living expenses saved up. Start by setting a $2,000 goal.

✅ Invest Smartly – Stocks, real estate, or your own business? Choose assets that grow over time.

✅ Enjoy everyday life – After allocating 30% of your income to give, save, and invest, use the remaining 70% to enjoy life and take care of your bills and other financial responsibilities. Set up automatic bill payments and other financial obligations to save time. Follow the 30/70 Rule as much as you can. It may be challenging in the beginning, but it gets better with practice.

Example:

Dr. Sophia set up an automatic transfer of $500/month into an S&P 500 index fund to her stock market investment account (brokerage account). Ten years later, that money had grown to over $100,000 without her doing anything extra!

“Don’t work for money—make money work for you.” – Robert Kiyosaki

Step 5: Join a Winning Team & Keep Learning!

The fastest way to financial freedom? Surround yourself with successful, like-minded people!

How to Build a Winning Financial Team:

✔ Join a community – Connect with business-minded women in the Optometry Divas network!

✔ Find a mentor – Learn from someone who has already built wealth.

✔ Hire financial pros – A financial advisor, CPA, and attorney can help you make smart moves and protect your wealth.

Example:

Dr. Natasha joined Optometry Divas and started learning from other successful women. Within a year, she had doubled her savings and invested in her first rental property!

“Success is never a solo journey. A great team makes all the difference.” – Dr. Lauretta Justin

Final Thoughts: You’ve Got This!

Mastering personal finance doesn’t have to be scary. With the right mindset, strategy, and support, you CAN achieve financial freedom.

Your Action Plan (5 Simple Steps!):

✅ Step 1: Shift to a Winning Mindset – Believe you can create wealth!

✅ Step 2: Create a budget or a financial plan That Works – Control your money instead of letting it control you.

✅ Step 3: Eliminate Bad Debt – Use the Snowball or Avalanche Method.

✅ Step 4: Pay Yourself First & Invest – Build wealth, not just income.

✅ Step 5: Join a Community & Keep Learning – Surround yourself with success!

🚀 Call to Action: Join the Optometry Divas Community!

Ready to take control of your financial future and surround yourself with like-minded women who are winning with money?

🔥 Join the CEO of YOU® Private Practice Membership! 🔥

✅ Exclusive financial & business coaching

✅ Inspiring success stories & mentorship

✅ Proven strategies to build wealth & independence

🔹 Join us today at OptometryDivas.com/join and start your journey toward financial freedom!

Disclaimer

This blog post is for educational purposes only, and does not constitute financial advice. Always consult a licensed financial advisor before making investment decisions.